Default Sales Tax v/s Product Sales Tax Mapping 0 0

Please ensure that you configure one of the two tax options available for your business setup. If your business operates in a region where all products are subject to the same tax rates, utilize the Default Sales Tax Mapping. Alternatively, if your business operates in a region where products are subject to varying tax rates, opt for Product Tax Mapping.

Before proceeding with tax mapping, ensure that you have created individual or group taxes as outlined in the previous step.

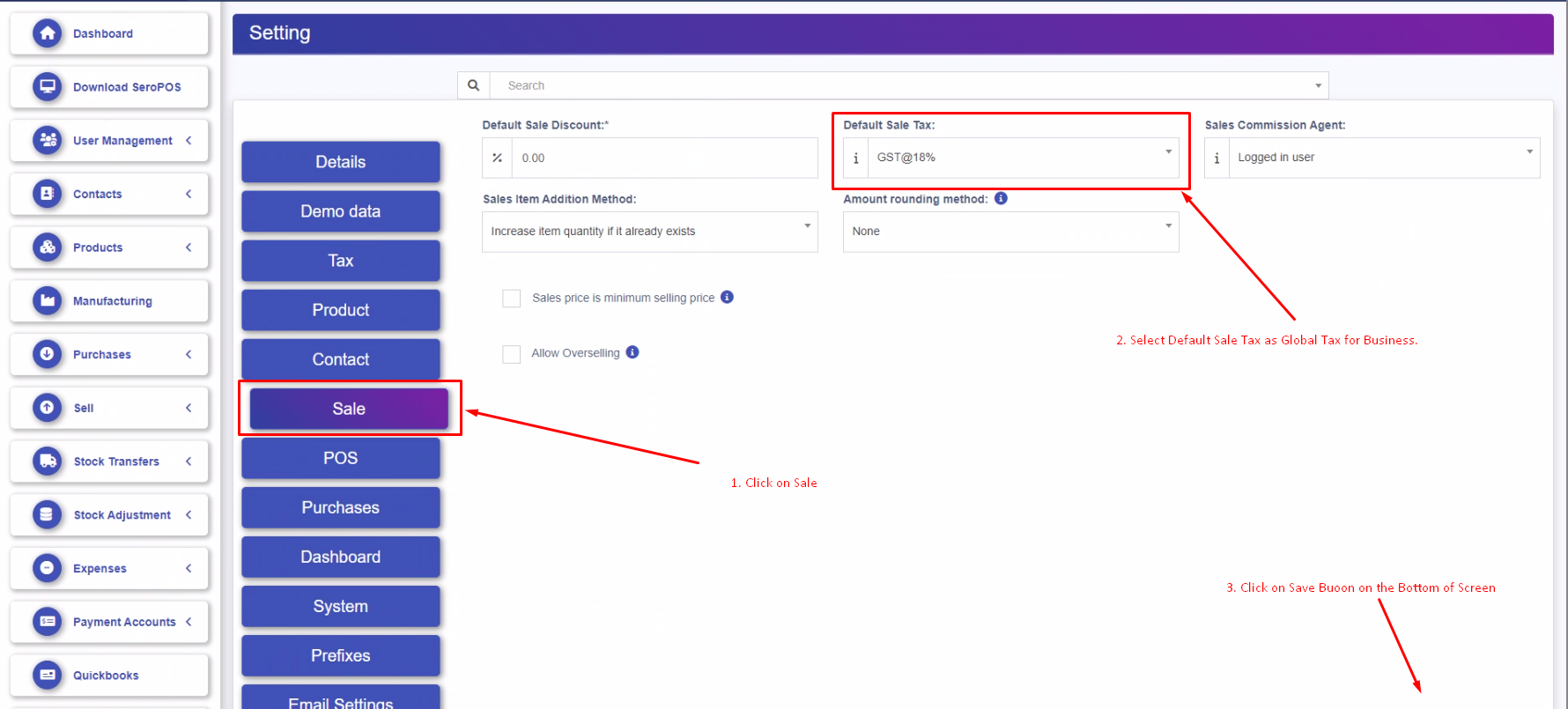

For Default Sales Tax Mapping:

- 1. Navigate to Settings, then Sales.

- 2. Select the Default Sales Tax from the dropdown menu to establish it as the global tax for your business.

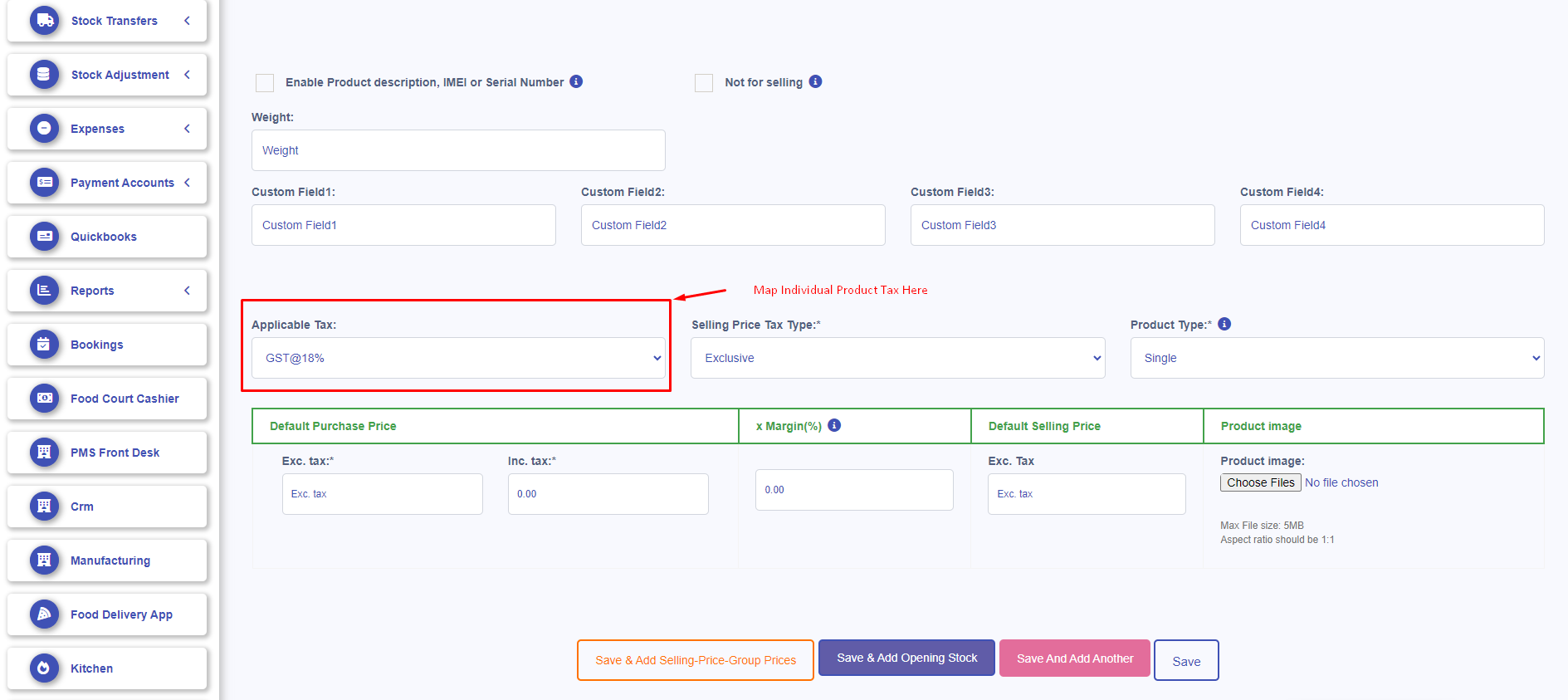

For Product Tax Mapping:

- 1. While adding a product, complete the product details.

- 2. Scroll down to the "Applicable Tax" section.

- 3. From the dropdown menu, select the appropriate tax for the product and save the details.

Note: If Default Sales Tax Mapping is selected, refrain from assigning individual taxes to products. Conversely, if individual taxes are chosen for products, ensure that taxes are mapped individually for all products and refrain from mapping Default Sales Tax.